A laser diode is a semiconductor device that produces lasing conditions when a current is injected directly. It is capable of producing light directly from electrical energy. Many laser engraving and cutting machines are produced using this principle, and laser engraver have gradually been used by more and more families from the industry.

CHINA, Oct. 21, 2022 (GLOBE NEWSWIRE) -- Reportlinker.com announces the release of "Global Laser Diode Market Size, Share and Industry Trends Analysis Report, by Wavelength, Technology, End-use, Doping Materials, and Regional Outlook and Forecasts. , a laser diode works similarly to a light-emitting diode in that when it is in direct contact, it may create a lasing condition at its junction when pumped with a current.

In modern laser diodes, the wavelength of the output beam spans the infrared to ultraviolet spectrum, determined by the choice of semiconductor material. The most common lasers manufactured are laser diodes, which have a variety of applications. Using phosphors similar to those on white LEDs, laser diodes can be used as general lighting sources. It can also be used to produce laser engraving machines.

Doping pn transitions driven by voltage enables mixing of electrons and holes. Radiation in the form of incident photons is produced when electrons drop from a higher energy level to a lower energy level. This is an unintentional emission. Stimulated emission occurs when this process is repeated and new light containing the same phase, coherence and wavelength is produced.

The pn junction in a regular diode functions like a revolving gate, allowing current to flow only one way (called forward-biased operation). When electrons cross this barrier and combine with holes on the other side, photons -- packets of light in the visible range. From an electrical point of view, a laser diode is actually a PIN (P-type Intrinsic N-type) diode.

COVID-19 Impact Analysis

Manufacturers can benefit from other possibilities for laser products to diversify their revenue streams. The closure of movie theaters due to the COVID-19 pandemic has had a significant negative impact on the growth of the market, as has the reduced adoption of new laser projectors in the media and entertainment sector. Different methods of fabricating different forms of laser diodes contribute to their versatility. Thus, it can be seen that the pandemic has had a negative impact on the laser diode market, which is turning positive following market innovations. Use of Laser Diodes in Industrial Applications

Market Growth Factors Surge

From 790 nm to 980 nm, the laser industry has seen a surge in demand for high-power, high-brightness lasers. The number of high-power lasers used in defense, medical, consumer electronics, and fiber laser pumping has proliferated. Multi-mode semiconductor lasers have larger emitters and can generate more power than single-mode laser diodes and belong to high-power laser diodes. The output power varies according to the desired wavelength.

The rise of laser diodes for biomedical applications

As the industry has grown, 660 nm laser diodes have been used for a wide variety of applications, including specialty line laser beams and measurement lasers. The penetration depth of red light into biological tissue is particularly deep, about 2-3 mm in the case of human skin. This penetration depth is characteristic of light in the 670-690 nm band, slightly higher than the wavelengths previously described.

Market Constraints

Huge Cost of Initial Investment in Laser Diode Industry

Compared with other light-emitting diodes, the initial investment required for laser diodes is high, which greatly limits the overall laser diode market. The laser power required for various systems, processes and applications varies from a few hundred watts to several kilowatts. Although the use of laser products in the industrial and automotive fields reduces labor costs, installing laser products is quite expensive. The cost of installing a laser product is usually higher than using standard techniques.

Wavelength Outlook

Based on wavelength, the laser diode market is segmented into infrared, red, cyan, blue-violet, and ultraviolet. The infrared laser diode segment will gain the highest revenue share in the laser diode market in 2021. Phase-shift ranging techniques or long time-of-flight are often used for NIR laser diodes. NIR laser diodes with substrates such as AlGaAs and GaAs have wavelengths ranging from 705 nm to 1,300 nm.

Doping Materials Outlook

Based on doping material, the laser diode market is segmented into Gallium Arsenide (GaAs), Gallium Aluminum Arsenide (GaAIAs), Gallium Nitride (GaN) and Indium Gallium Nitride (InGaN), Gallium Indium Arsenide (GaInAsSb), Aluminum Gallium Indium Phosphide (AIGaInP) etc. In 2021, the AlGaAs segment will gain a significant revenue share in the laser diode market. Heterostructure lasers made of gallium arsenide (GaAs) can also be easily fabricated by combining gallium arsenide (GaAlAs) based laser diodes with other optical components.

Technology Outlook

Based on technology, the laser diode market is segmented into double heterostructures, quantum wells and cascades, distributed feedback, SCH, vertical cavity surface emitting laser (VCSEL) diodes, and vertical external cavity surface emitting laser (VECSEL) diodes. Separation-confined heterostructure laser devices will have a significant revenue share in the laser diode market in 2021. The light guide region, the active region inside the light guide region, and the n-type and p-type jacket region regions on either side of the light guide constitute a unique confinement heterostructure laser device.

End-use Outlook

On the basis of end-use, the laser diode market is segmented into telecommunications, industrial and automotive, medical and healthcare, consumer electronics, and others. The consumer electronics segment will capture the largest revenue share in the laser diode market in 2021. The wavelength of the output beam in modern laser diodes spans the infrared to ultraviolet spectrum and is determined by the choice of semiconductor material.

Regional Outlook

On the basis of region, the laser diode market is analyzed in North America, Europe, Asia Pacific, and LAMEA. Asia Pacific dominates the laser diode market with the largest revenue share in 2021. This is because of the expanding telecommunications and industrial uses in the region. The steady expansion of manufacturing in emerging countries in the Asia-Pacific region is likely to drive the demand for laser diodes in the region.

The main strategy followed by market players is product launches. Based on analysis in a cardinality matrix; Sharp Corporation, Jenoptik AG, MKS Instruments, Inc. are pioneers in the laser diode market. Companies such as ROHM Semiconductors Co., Ltd., II-VI Incorporated, Lumentum Holding, Inc. are some of the key innovators in the laser diode market.

The market research report covers the analysis of the key stakeholders of the market. Major companies featured in the report include II-VI Incorporated, IPG Photonics Corporation, Jenoptik AG, Lumentum Holding, Inc., MKS Instruments, Inc., ams-OSRAM AG, Rohm Semiconductors Co., Ltd., Sharp Corporation, Ushio, Inc. . ., and Hamamatsu Photonics KK

Recent Strategies Deployed in the Laser Diode Market

Partnerships, Collaborations and Agreements:

March 2022: Lumentum Holdings reaches agreement with Ayar Labs, a leader in chip-to-chip optical connectivity. Under the agreement, the two companies aim to provide large quantities of CW-WDM MSA compliant external laser producers. The light source is critical to powering Ayar Labs' optical I/O solution, which provides computing and networking with wider bandwidth, energy efficiency and latency advantages over current short-reach copper links.

Product launches and product expansions:

August 2022: MKS Instruments introduces the Spectra-Physics Talon 532-70 laser. The laser delivers over 70W of sustainable power and functionality at high frequency rates up to 700kHz with sustained high power and low noise. The Talon 532-70 laser allows high-throughput processing of photovoltaic and advanced electronic materials, including system-in-package or SiP and PCBs for electric vehicles and other similar applications.

April 2022: Lumentum introduces the FemtoBlade laser system, the company's second-generation line of high-precision ultrafast industrial lasers. FemtoBlade laser systems feature a modular design that delivers high power at high frequencies, providing greater flexibility and faster processing.

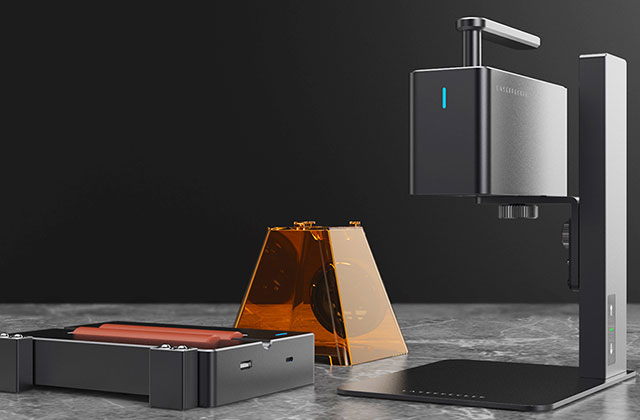

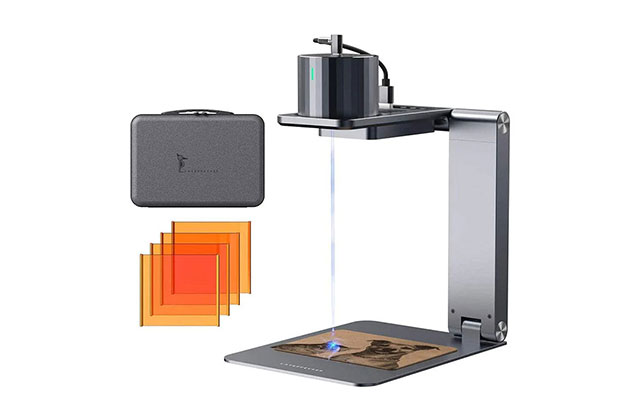

April 2022: LaserPecker launched the latest handheld laser engraving and cutting LaserPecker 3, which is the latest laser engraving machine launched by the company, which can perfectly match the use of home users, and improve the speed of laser engraving, which can reach home more quickly and industrial use.LaserPecker 2 is another very good laser engraver

March 2022: IPG Photonics introduces LightWELD XR, its handheld laser welding and cleaning product. LightWELD XR is the company's third product in the series, which includes an expanded range of materials including the aluminum 6XXX series, nickel alloys, titanium and copper. With this product, the company offers manufacturers the most innovative and versatile handheld laser welding machines.

January 2022: Ams Osram introduces the Oslon Black Flat X, the brightest automotive headlamp LEDs on the market. The Oslon Black Flat X offers 460 lumens at 1 A and can be purchased in 1-chip and 2-chip variants.

October 2021: ROHM introduces the RLD90QZW3 high light output laser diode. The RLD90QZW3 is intended for use in AGVs (Automated Guided Vehicles) and service robots in the industrial sector, as well as robotic vacuum cleaners and similar devices incorporating LiDAR in the consumer sector.

June 2021: Ushio introduces 200mW high power single-mode laser diode (LD). These diodes are efficient and compact, providing red light sources at 675nm and 690nm. These diodes can be used in a wide range of applications including research and development in the life sciences, biomedical and quantum fields.

November 2020: Ushio introduced the HL40093MG, a 404nm laser diode. The HL40093MG provides 400mW of continuous wave (CW) output power in Ushio's standard MG (TO-56) 5.6mm diameter CAN package and operates from 0 to 30°C. With this product, Ushio has expanded its violet product range to meet the needs of violet laser diodes (398-410nm emission wavelength) for industrial applications, etc.

Acquisitions and Mergers:

August 2022: Lumentum Holdings acquires NeoPhotonics Corporation, a leading developer and manufacturer of lasers and optoelectronic solutions. With this acquisition, Lumentum is focused on expanding its business in optoelectronics, lasers and cloud-based infrastructure.

August 2022: MKS Instruments acquires Atotech Limited, a global leader in process chemicals, equipment, software and services for printed circuit boards, semiconductor IC packaging and surface treatment. With this acquisition, MKS redefines the blueprint for the next generation of advanced electronics.

July 2022: VI Incorporated acquires Coherent, a company that manufactures and supports laser equipment and components. Through this acquisition, II?VI and Coherent have combined their businesses to form a leader in materials, networking and lasers. The acquisition combines II-VI's scale at the level of the value chain where materials expertise is required with Coherent's scale in laser systems.

September 2020: Jenoptik acquires TRIOPTICS, a leading manufacturer of optical test equipment. Through this acquisition, the two companies benefit from their complementary portfolios. The acquisition further enables both companies to offer a wider range of measurement systems, as well as fabrication facilities for sensor solutions and optical microcomponents.

Geographic expansion:

July 2022: Hamamatsu Photonics expands its geographic footprint with the construction of Plant 5 at its Joko factory in Japan. The facility will handle growing sales of imaging and measurement instruments, such as digital cameras developed for scientific measurement, digital slide scanners for pathology, and semiconductor failure analysis systems.

Area of Research Market Segments Covered in the Report:

By Wavelength

- Infrared

- red

- blue and green

- blue purple

- UV rays

By Technology

- Distributed feedback

- Confine heterogeneity alone

Structure, Double heterostructure

- Quantum Wells and Cascades

- VCSELs and VECSELs

By End Use

- • Consumer Electronics

- Telecom

- Industrial and Automotive

- Medical and health care

- other

- dopant material

- Gallium Arsenide (GaAs)

- Gallium Aluminum Arsenide (GaAIAs)

- Gallium Nitride (GaN) and Indium Gallium Nitride (InGaN)

- Gallium Indium Arsenide (GaInAsSb)

- Aluminum Gallium Indium Phosphide (AIGaInP) •

- other areas

- North America

- United States

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- Italy

- Rest of Europe

- • Asia-Pacific

- China

- Japan

- India

- Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- United Arab Emirates

- Saudi Arabia

- South Africa

- Nigeria

- Other

Company Profile

- • IPG Photonics Corporation

- • Jenoptik AG

- • Lumentum Holding, Inc.

- • MKS Instruments, Inc.

- • ams-OSRAM AG

- • Rohm Semiconductors Co., Ltd.

- • Sharp Corporation

- • Ushio, Inc.

- • Hamamatsu Photonics KK

HTPOW Offers Unique Products and a Range of Professional Services

- Detailed coverage

- Most market tables and data

- Offers a subscription-based model

- Guaranteed best price

- HTPOW Great Service